E-cigarettes have gained significant popularity over the years, prompting various governmental bodies to impose taxes on these products. Understanding how e-cigarette taxes work is crucial for both consumers and manufacturers. This comprehensive guide aims to shed light on the workings, implications, and reasoning behind e-cigarette taxes, particularly focusing on how these taxes affect the end-users.

What Are E-cigarette Taxes?

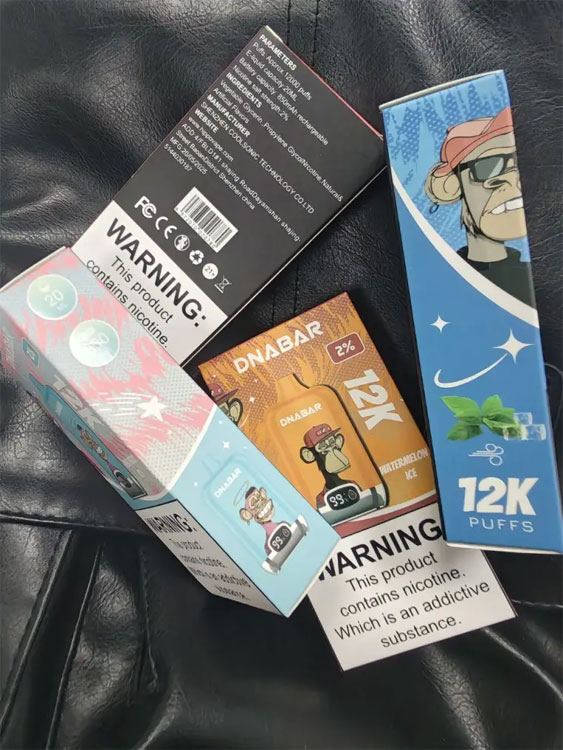

Just like traditional tobacco products, e-cigarettes are subject to taxation in many regions around the world. The primary aim of these taxes is to discourage usage, particularly among minors, and to generate revenue that can be used for public health initiatives. These taxes can vary from state to state and country to country, and they may be based on the product’s price, weight, nicotine content, or some combination thereof.

A Deeper Dive into Tax Structures

E-cigarette taxes generally fall into three categories: ad valorem, specific, and combination. Ad valorem taxes are charged as a percentage of the product’s price. This means that higher-priced products incur higher taxes, making it a revenue-rich option for governments. Specific taxes, on the other hand, are levied based on quantity, such as per milliliter of e-liquid or per unit of sale, regardless of the price. Some jurisdictions may use a combination of both to maximize efficiency and control over pricing.

The Impact of E-cigarette Taxes on Consumers

Taxes inevitably increase the retail price of e-cigarettes and their accessories, placing a burden on consumers. Higher prices often lead to decreased usage, especially among price-sensitive groups like teenagers. However, there is an ongoing debate about whether e-cigarette taxes are more of a deterrent or an unfair financial burden on adult users who rely on vaping as a smoking cessation aid.

According to research, while e-cigarette tax increments may lower the usage rates among youths, there’s little evidence to suggest it effectively curbs adult consumption.

Effects on Manufacturers and Retailers

The imposition of e-cigarette taxes also greatly affects manufacturers and retailers. These industries must balance the increased operational costs due to taxes with consumer price sensitivity. Smaller businesses, in particular, may struggle to absorb these costs, potentially leading to market consolidation where larger companies dominate.

Governmental and Public Health Perspectives

From a policy perspective, e-cigarette taxes serve dual purposes: reducing harm and generating revenue. Governments see an opportunity to use tax revenue in bolstering public health campaigns and research into the long-term effects of e-cigarette usage. However, this raises questions around the ethics of leveraging public health risks for revenue.

Conclusion

Understanding how e-cigarette taxes work involves considering various economic, health, and social aspects. Consumers and businesses must stay informed to navigate this complex landscape effectively.

FAQs on E-cigarette Taxes

Do all states have the same e-cigarette tax laws?

No, e-cigarette tax laws vary significantly from state to state. It’s essential for consumers and businesses to understand the specific regulations in their state.

How do e-cigarette taxes impact smoking cessation efforts?

While taxes are meant to discourage use, they could potentially hinder some adults looking to transition from traditional cigarettes, which may be viewed as counterproductive to smoking cessation efforts.

What future changes can we expect in e-cigarette taxation?

Given the increasing scrutiny of e-cigarettes, we can expect more regulations and potentially higher taxes aimed at aligning them with traditional tobacco products.